Reuters

Everybody could use a Charlie Munger

D.Adams3 months ago

Berkshire Hathaway Chairman Warren Buffett (left) and Vice Chairman Charlie Munger are seen at the annual Berkshire shareholder shopping day in Omaha, Nebraska, U.S., May 3, 2019. REUTERS/Scott Morgan Acquire Licensing Rights

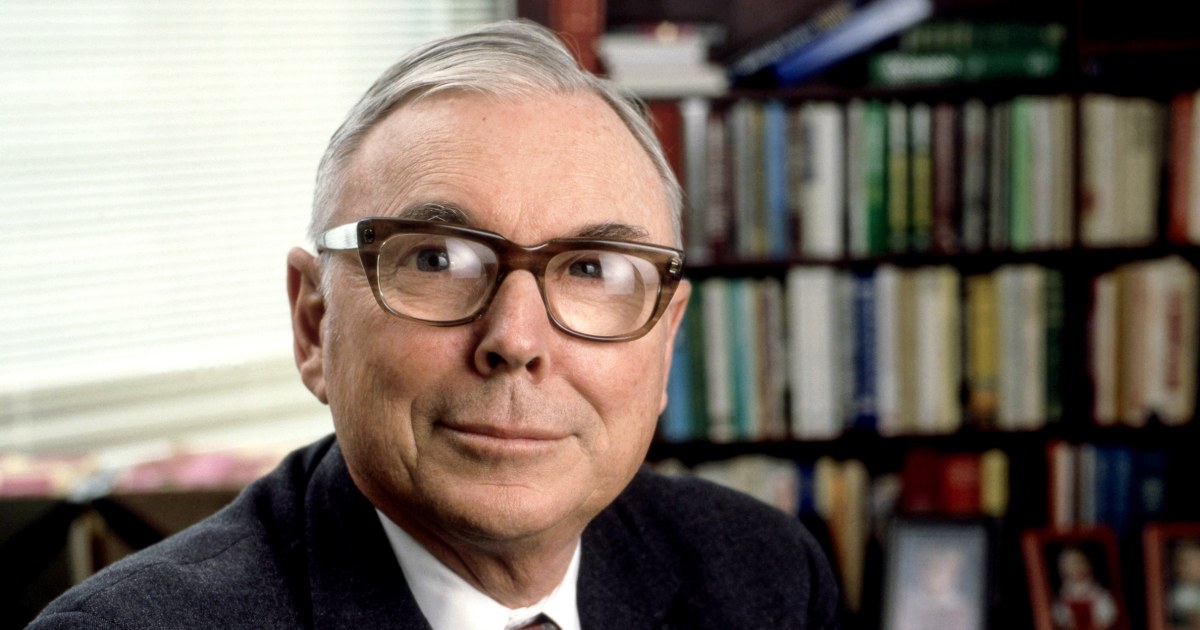

NEW YORK, Nov 29 (Reuters Breakingviews) - Every great leader needs a Charlie Munger. The deputy to Berkshire Hathaway’s (BRKa.N) Warren Buffett died on Tuesday morning just a month shy of his 100th birthday. He dubbed himself the “cheerful pessimist,” delivering wry one-liners on the Omaha stage of the firm’s annual gatherings. But Munger’s best quality, being a sounding board for the boss who received the majority of the fame and fortune, might have made him Buffett’s best value investment. Munger, who like his boss once worked at a grocery store owned by Buffett’s family, would occasionally crunch snacks at Berkshire’s investor meetings while lobbing in his two cents. “In my life, I try and avoid the things that are stupid and evil and make me look bad in comparison to somebody else, and bitcoin does all three,” he said at the 2022 meeting. And Munger kept at it: at age 99, having served as Berkshire’s vice chairman since 1978, he was still giving interviews as recently as this month. Buffett told CNBC’s Becky Quick in 2018 that “business life is more fun with a good personal partner.” But Munger was always destined to be the junior partner: As the older of the two Berkshire leaders, he was never seen as a natural successor to the throne. Day-to-day oversight of the firm has already been handed to Greg Abel and Ajit Jain. Munger’s passing should have little effect on how Berkshire is run. But his past role in the firm’s investment decisions are another story. Munger was capable when taking the opposite view from his boss, encouraging the kind of debate that fosters better decisions. And Munger’s dogged evangelism had its strengths, even when Buffett decided to go the other way. The two former shelf-stackers disagreed, for instance, on Costco Wholesale (COST.O) . Berkshire sold its position in 2020; Munger held on to his own stake. Since then, the stock has returned 64% including dividends. Over the years Munger sat by his side, that acumen helped Buffett earn accolades as the “Sage of Omaha,” with Berkshire’s shares returning 18% annually since 1978, double the S&P 500 Index (.SPX) . It also earned Munger stock ultimately worth some $2 billion, according to LSEG. That’s not too shabby. But he remained the junior partner here too, overshadowed by Buffett’s $118 billion stake. Given his part in creating that value, Munger might have offered the most outsized return of Buffett’s career. (The author is a Reuters Breakingviews columnist. The opinions expressed are their own.) CONTEXT NEWS Charlie Munger, the longtime vice chairman and second-in-command to Warren Buffett at Berkshire Hathaway, died at a California hospital, the company said on Nov. 28. Munger was 99, and would have turned 100 on Jan. 1. “Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation,” Buffett, Berkshire's chairman and chief executive said in a statement.Read the full article:https://www.reuters.com/breakingviews/everybody-could-use-charlie-munger-2023-11-29/

0 Comments

0

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7ZQWXJXD2FOIXCERPKAYFYE3AY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ODKR3FUVGBOVLKHC5LLEW3ZJKM.jpg)